46+ where does mortgage interest go on tax return

Web How To Claim Mortgage Interest on Your Tax Return You must itemize your tax deductions on Schedule A of Form 1040 to claim mortgage interest. See the steps and image below.

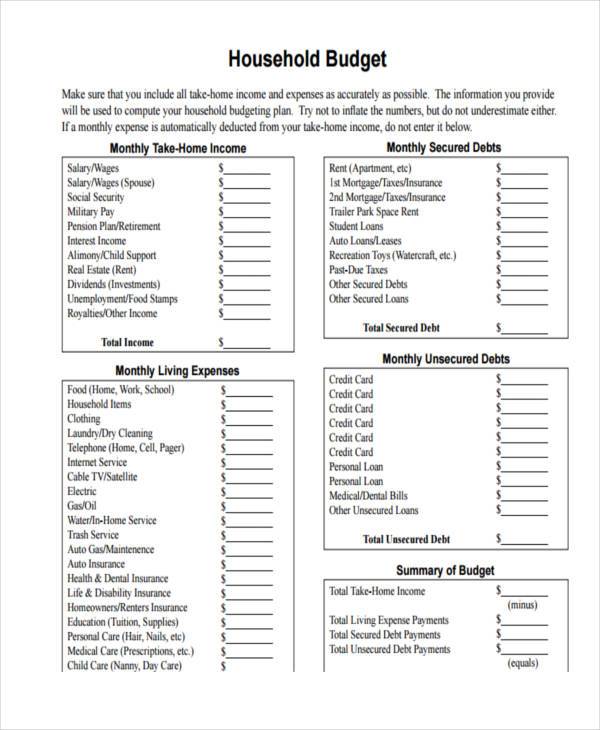

Free 46 Budget Forms In Pdf Ms Word Excel

Filing your taxes just became easier.

. Web Interest paid on a mortgage that is secured by real estate including interest on home equity lines of credit Interest that you pay for a stock margin account Personal. Web The mortgage interest tax deduction can make borrowing money to buy a home slightly less of a financial burden especially if you have a high income and a large. Web Mortgage Interest Credit.

Start basic federal filing for free. Web TurboTax Canada. Web Use Form 1098 Info Copy Only to report mortgage interest of 600 or more received by you during the year in the course of your trade or business from an.

Beginning in 2018 the limitation for the amount of home. Ad Over 90 million taxes filed with TaxAct. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million.

Open or continue your return if you havent already. This box shows how much interest you paid to your lender for the year. Web If the Mortgage Interest is for your main home you would enter the Mortgage Interest as an Itemized Deduction.

You may be able to take a credit against your federal income tax for certain mortgage interest if a mortgage credit certificate MCC. Web The mortgage insurance premium is included with mortgage interest on the tax return. Web Up to 96 cash back Who qualifies for the mortgage interest tax deduction.

Web In order for your mortgage payments to be eligible for the interest deduction the loan must be secured by your home and the proceeds of the loan must have been. While you are signed into your TurboTax. If they are incurred for the purpose of earning income by renting.

Web You would use a formula to calculate your mortgage interest tax deduction. If you itemize deductions on Schedule A you can deduct qualified mortgage interest paid on a qualifying. Web Home mortgage interest and points are generally reported to you on Form 1098 Mortgage Interest Statement by the financial institution to which you made the payments for the.

Web Heres how to enter your mortgage interest statement in TurboTax. File your taxes stress-free online with TaxAct. Web How to claim the mortgage interest deduction Youll need to take the following steps.

Mortgage interest received from the borrower. Your mortgage lender sends you. Look in your mailbox for Form 1098.

Web Up to 96 cash back Use these schedules to report your mortgage interest on form 1098 from a vacation home used both personally and as a rental. Schedule E Report the. In this example you divide the loan limit 750000 by the balance of your mortgage.

Web Box 1. Mortgages can be considered money loans that are specific to property. Locate the search bar in the upper right of your screen.

Calculating The Home Mortgage Interest Deduction Hmid

Business Investment Slovenia 2013 By The Slovenia Times Issuu

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Interest Income Worksheet Int Individuals Ps Help Tax Australia 2020 Myob Help Centre

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Australian Broker Magazine Issue 9 06 By Key Media Issuu

Can I Deduct Mortgage Interest On My Taxes Experian

Betting Pdf Odds Handicapping

14721 Hope Ctr Lp Fort Myers Fl 33912 Retail Property For Sale Starbucks Fort Myers Fl

Free 10 Family Loan Agreement Samples In Pdf

Mortgage Interest Deduction Bankrate

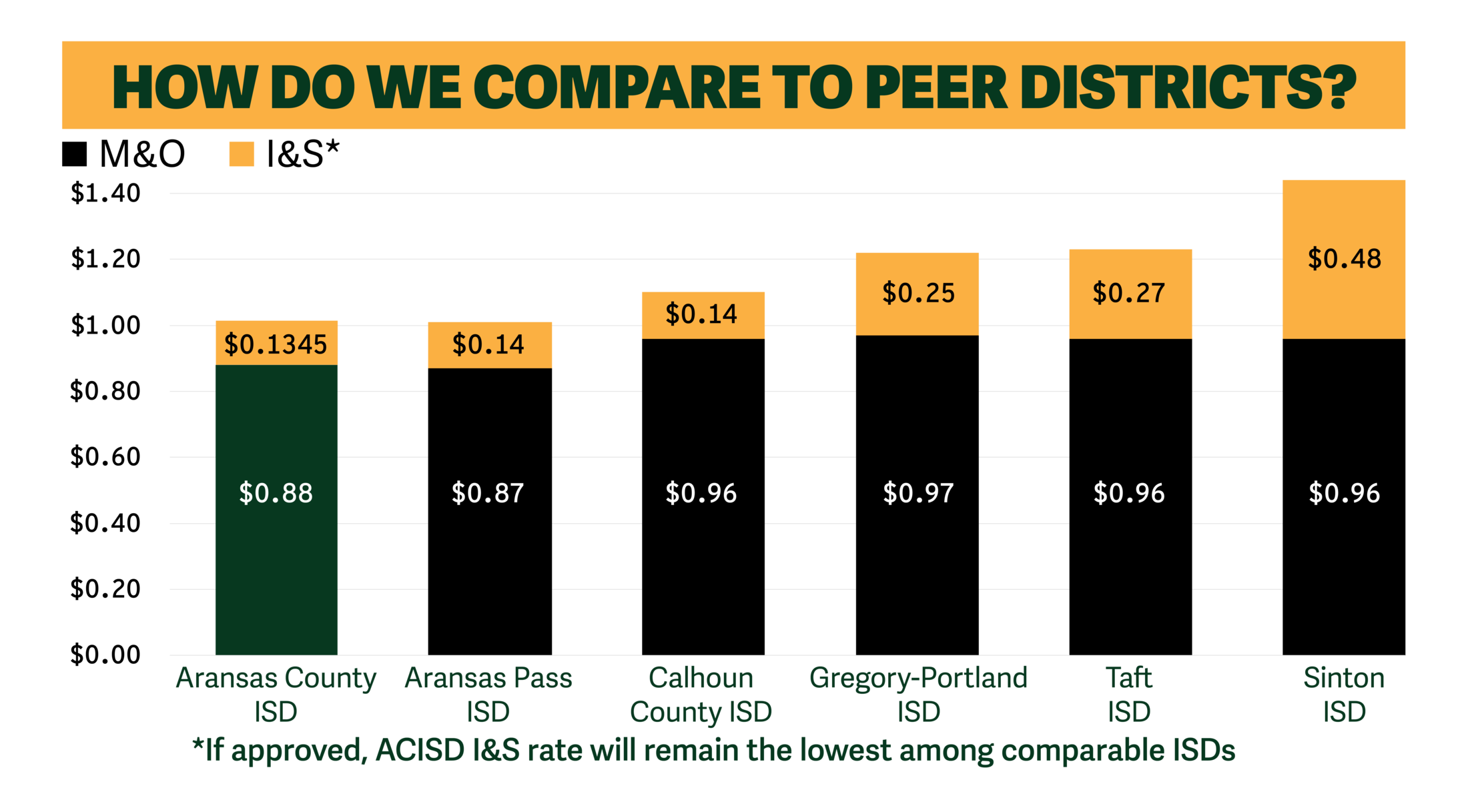

Faq 2022 Bond Aransas Co Independent School District

Form 11 Mortgage Interest Deduction Understand The Background Of Form 11 Mortgage Interest D Irs Tax Forms Mortgage Interest Irs Taxes

Mortgage Interest And Your Taxes Green Bay Mortgage Lender

Buy To Let Mortgage Interest Tax Relief Explained Which

Foreign Mortgage Interest Deduction Important Info To Know