Payroll calculator georgia 2023

This Tax Return and Refund Estimator is currently based on 2022 tax tables. Outlook for the 2023 Georgia income tax rate.

Georgia State University Holidays 2020 Georgia State University Georgia State State University

FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed.

. Fy 2022 state salary schedule folder name. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. So the tax year 2022 will start from July 01 2021 to June 30 2022.

Ad Payroll So Easy You Can Set It Up Run It Yourself. The standard FUTA tax rate is 6 so your. With Online Pay Stubs you can instantly Create pay stub for free within minutes.

Calculate your Georgia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state. Ad Process Payroll Faster Easier With ADP Payroll. Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

Use ADPs Georgia Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. These paycheck stubs can be used by employees as proof of their earnings employers can keep it. Calculating your Georgia state.

Georgia Payroll Calculator Tax Rates Use our easy payroll tax calculator to quickly run payroll in Georgia or look up 2021 state tax. For 2022 the minimum wage in Georgia is 725 per hour. Georgia Salary Paycheck Calculator.

The Georgia Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Georgia State. On the other hand if you make more than 200000 annually you will. Free Unbiased Reviews Top Picks.

If you have employees in Illinois you must be sure to take payroll taxes. Figure out your filing status work out your adjusted gross income. It will be updated with 2023 tax year data as soon the data is available from the IRS.

Medicare tax which is 145 of each employees taxable wages up to 200000 for the year. Free salary hourly and more paycheck calculators. Using an Illinois paycheck calculator will help you figure out your take-home pay.

Georgia annualmonthly salary schedule for 10 months employment base equals school year level of certification salary step t. Plug in the amount of money youd like to take home. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Get Started With ADP Payroll. It can also be used to help fill steps 3 and 4 of a W-4 form. All Services Backed by Tax Guarantee.

Ad Compare This Years Top 5 Free Payroll Software. Georgia tax year runs from July 01 the year before to June 30 the current year. As of 2022 the Medicare tax is 145 of your wage and the social security tax is 62 of your salary.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Free Unbiased Reviews Top Picks. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary.

Get Started With ADP Payroll. Discover ADP Payroll Benefits Insurance Time Talent HR More. Ad Process Payroll Faster Easier With ADP Payroll.

Employers can enter an. Prepare and e-File your. Just enter the wages tax withholdings and other information required.

Employers also have to pay a matching 62 tax up to the wage limit. Get Started With ADP Payroll. Outlook for the 2023 Georgia income tax rate is to.

Hourly employees who work more than 40 hours per week are paid at 15 times the regular pay rate. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators. All Services Backed by Tax Guarantee.

Ad Compare This Years Top 5 Free Payroll Software.

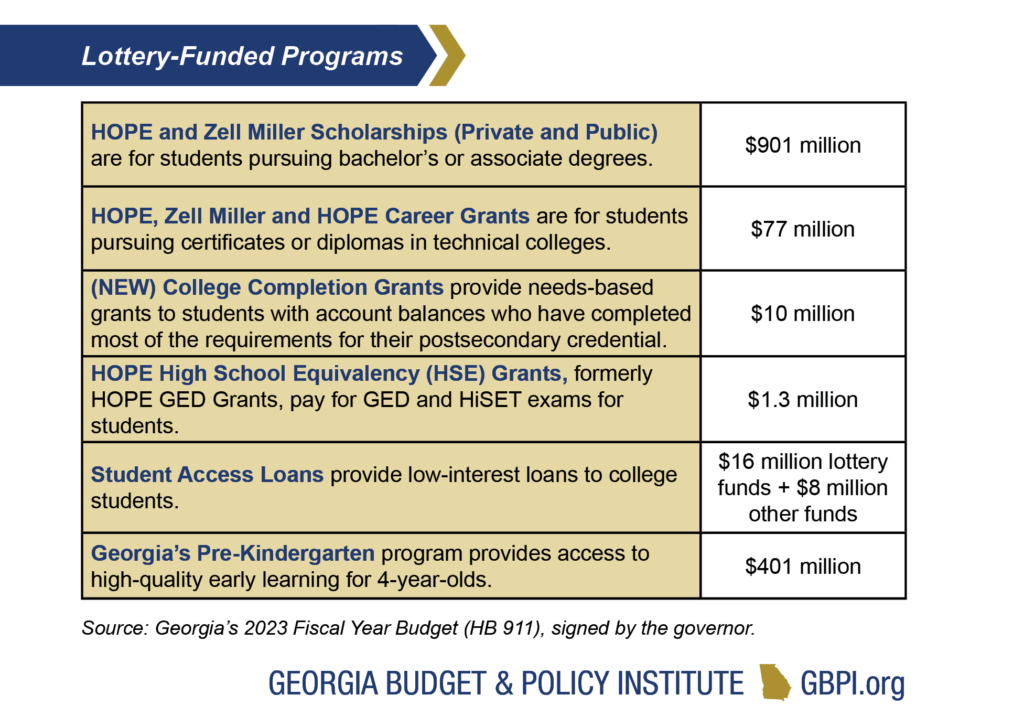

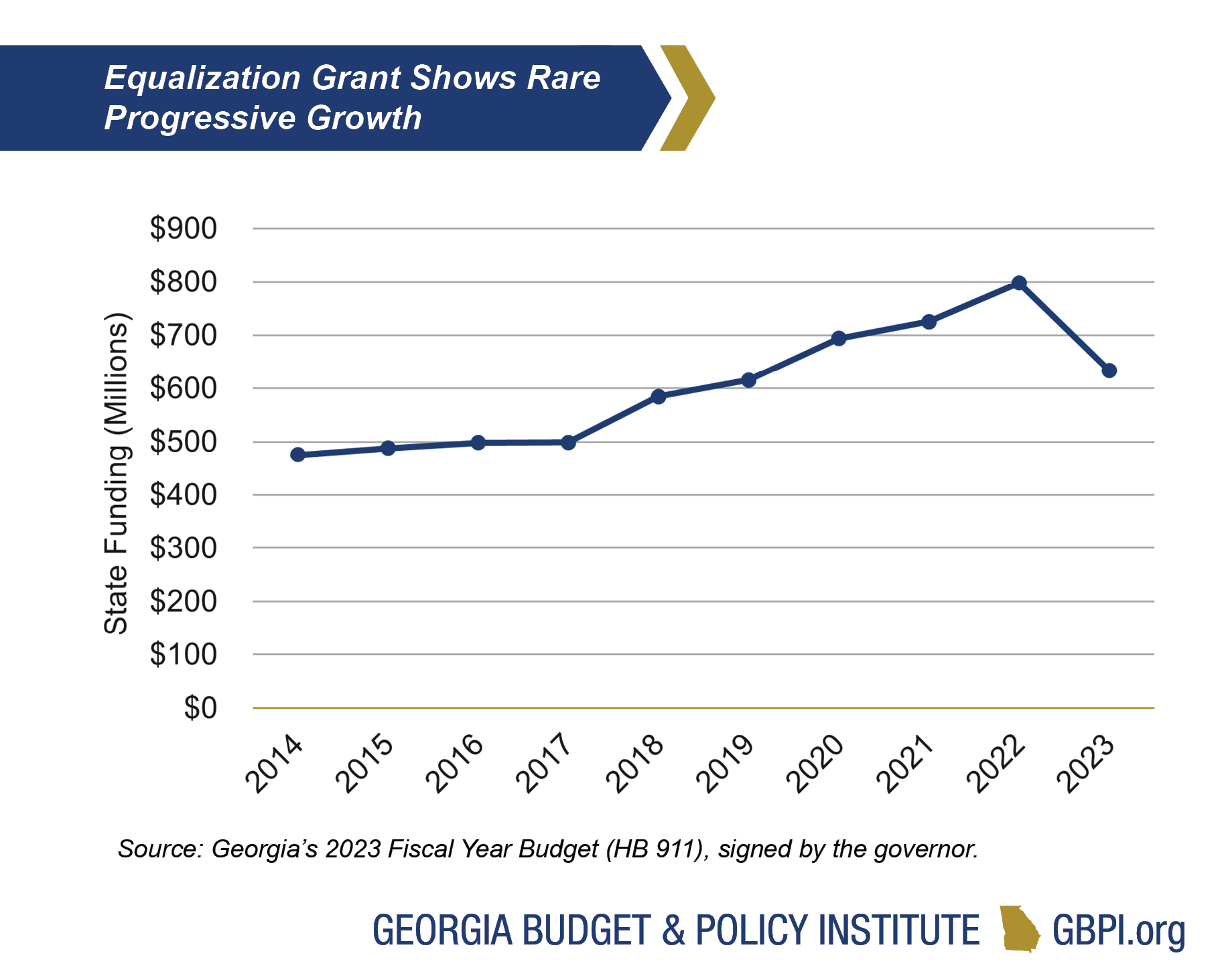

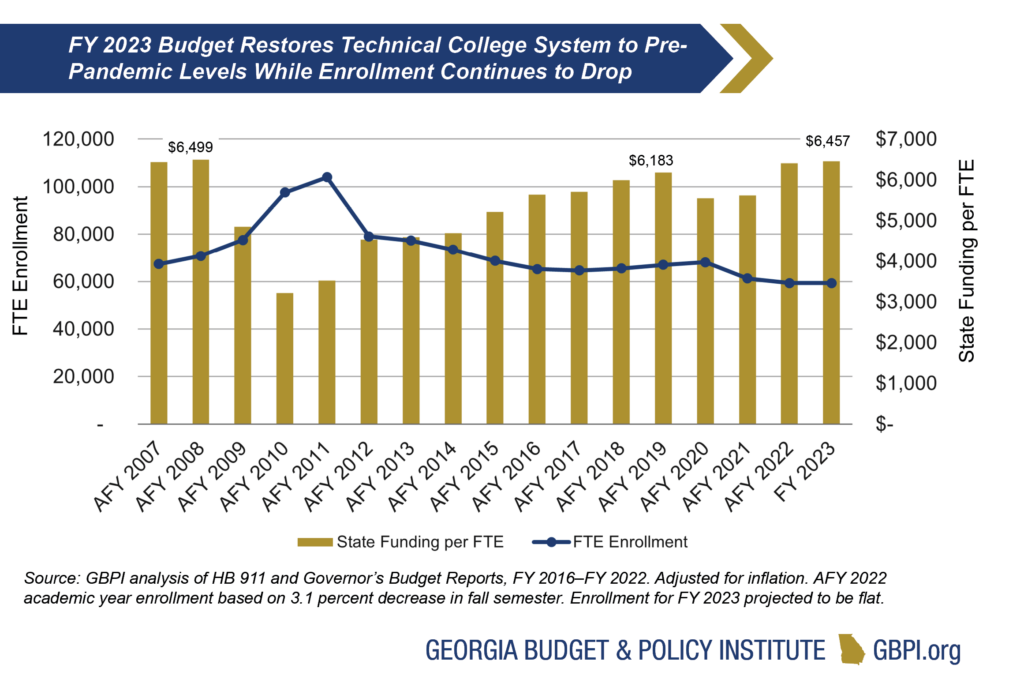

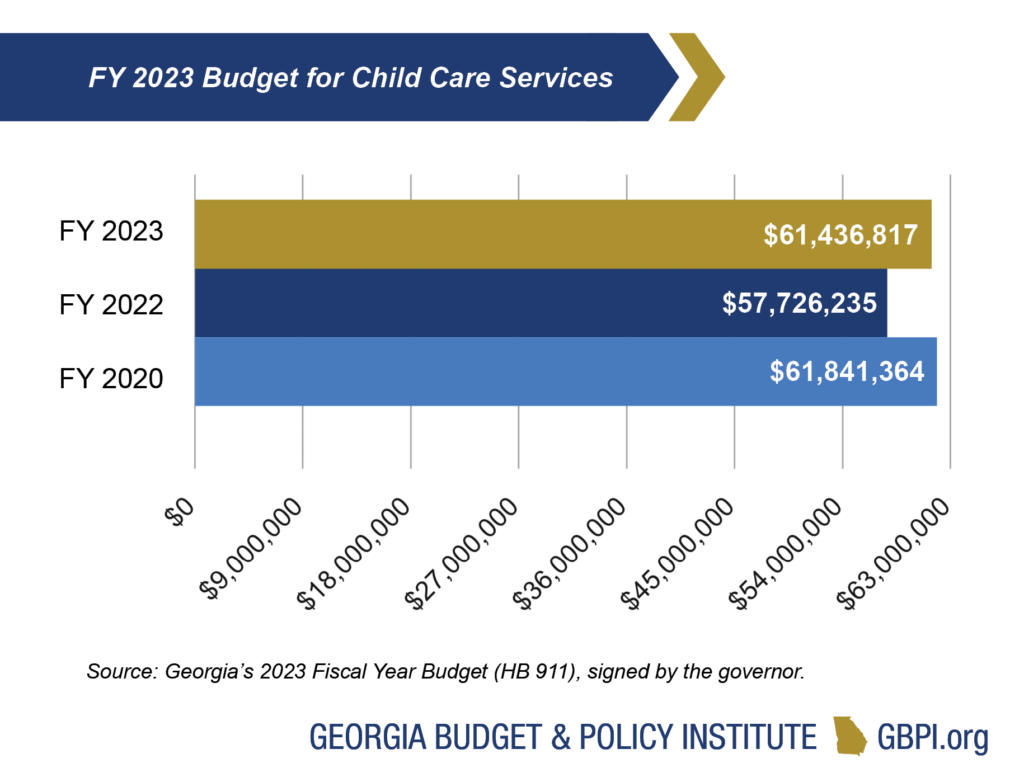

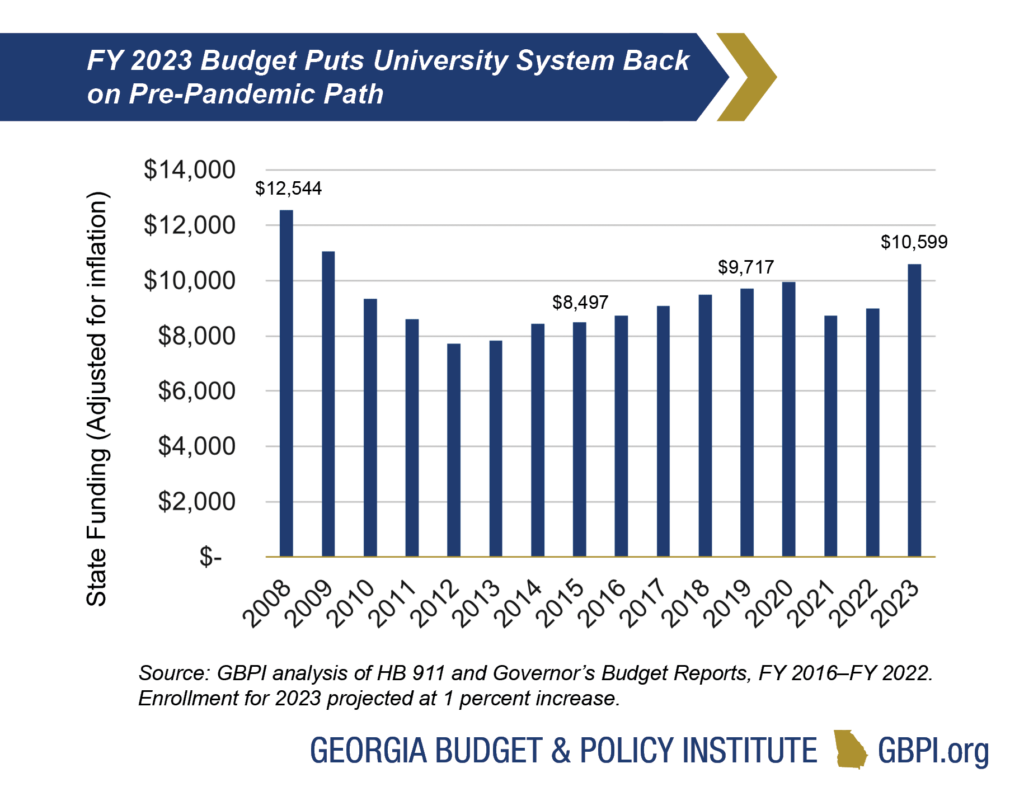

Georgia Education Budget Primer For State Fiscal Year 2023 Georgia Budget And Policy Institute

State Corporate Income Tax Rates And Brackets Tax Foundation

Eligibility Income Guidelines Georgia Department Of Public Health

2

Georgia Education Budget Primer For State Fiscal Year 2023 Georgia Budget And Policy Institute

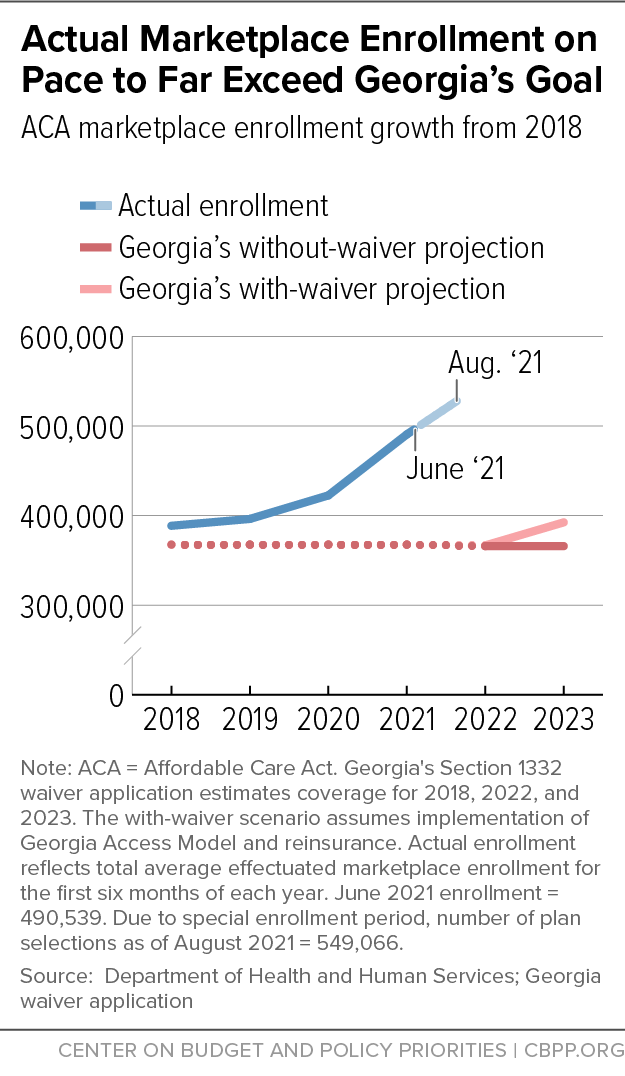

Georgia S Plan To Exit Marketplace Will Leave More People Uninsured Should Be Revoked Center On Budget And Policy Priorities

University Of Georgia 2022 2023 Desktop Calendar University Of Georgia

Georgia Education Budget Primer For State Fiscal Year 2023 Georgia Budget And Policy Institute

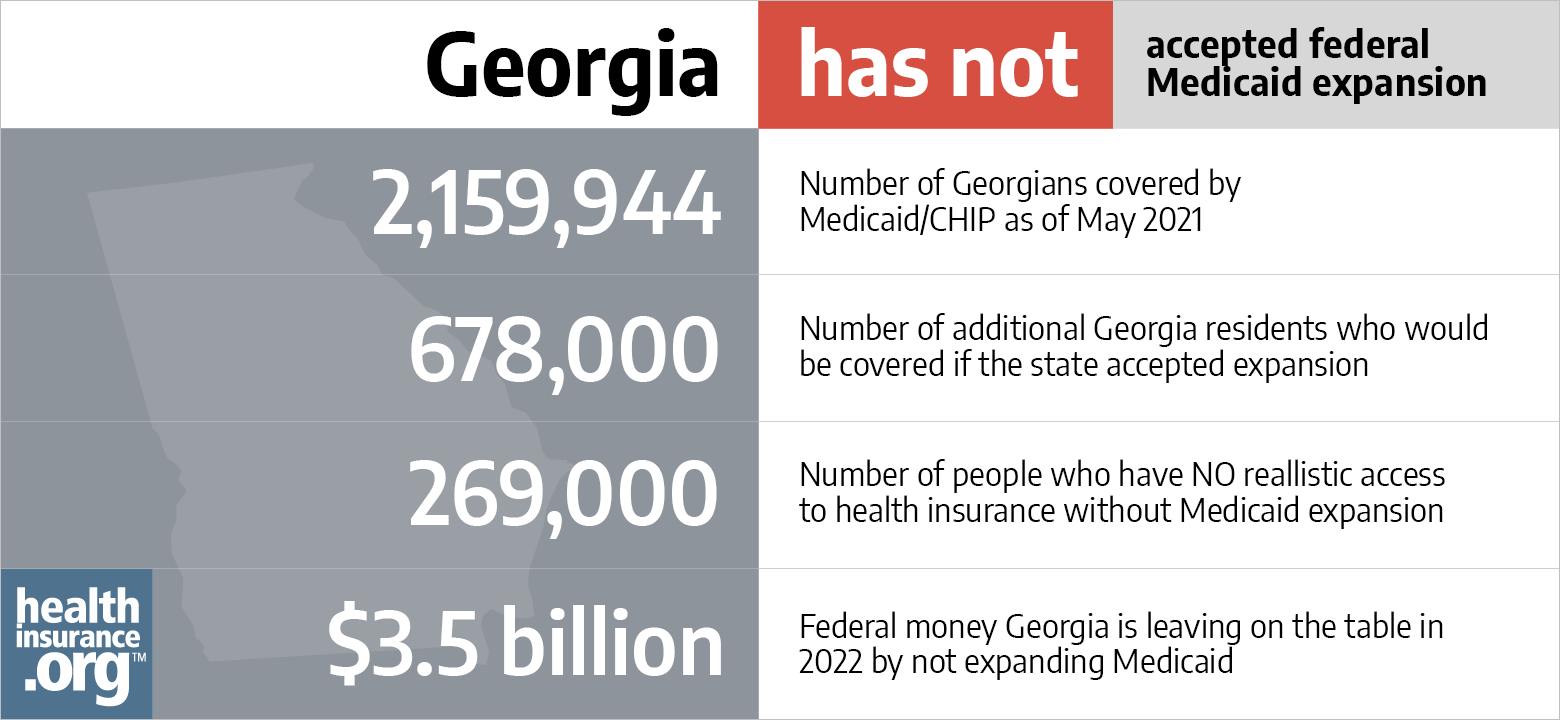

Aca Medicaid Expansion In Georgia Updated 2022 Guide Healthinsurance Org

Georgia Education Budget Primer For State Fiscal Year 2023 Georgia Budget And Policy Institute

Georgia S Plan To Exit Marketplace Will Leave More People Uninsured Should Be Revoked Center On Budget And Policy Priorities

News Employees Retirement System Of Georgia

Georgia Education Budget Primer For State Fiscal Year 2023 Georgia Budget And Policy Institute

Georgia Education Budget Primer For State Fiscal Year 2023 Georgia Budget And Policy Institute

2022 2023 School Calendar

Georgia Education Budget Primer For State Fiscal Year 2023 Georgia Budget And Policy Institute

2