Options average down calculator

Cost Average Down Calculator. And when not to average down on options.

/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-01-acdb55c99d224a48afe733fe552c796e.jpg)

Options Basics How To Pick The Right Strike Price

Please provide values below and click the Calculate button to get the result.

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

. Lets say you buy 100 shares at. The average price is multiplied by the number of times it occurs. Stock Symbol - The stock symbol that you purchased.

Calculator 13Average Down Calculator. The grant is for 2500 that can go toward the down payment and closing. For example you might order a trailing stop to sell your XYZ shares with a trailing.

Often a down payment for a home is expressed as a percentage of. The average down calculator will give you the average cost for average down or average up. Vega for this option might be 003.

If I buy more shares at a lower price what is my new average cost per share Description. A trailing stop triggers when a securitys price falls by the trailing amount. Prior to buying or selling an option a person must receive a copy of Characteristics and Risks of Standardized Options.

Use the calculator to determine how many shares of a stock and at what price you need to purchase them to cost average down to a certain average cost. The SAMCO Options Price Calculator is designed for understanding purposes only. Home 1 Average Down Calculator.

How much is the average down payment in 2022. Its intention is to help option traders understand how option prices will move in case of. In other words the purchase price of a house should equal the total amount of the mortgage loan and the down payment.

If you buy a stock multiple times and want to calculate the average price that you paid for the stock the average down calculator will do just that. For example a 30-day option on stock ABC with a 40 strike price and the stock exactly at 40. In other words the value of the option might go up 003 if.

A grant or second loan. Determine Average Share Cost when adding share to. Here is a calculator that.

Enter the number of shares you currently have and price per share on the corresponding columns. Options Type - Select call to use it as a call option calculator or put to use it as a put option calculator. For example lets say you buy 100.

Then on the second row enter the Stock Shares and Price. Copies of this document may be obtained from your broker from any. Averaging down is an investment strategy that involves buying more of a stock after its price declines which lowers its average cost.

Make sure it is on the same row. Using the average down calculator the user can calculate the stocks average price if the investor bought the stock differently and with other costs and share amounts. Calculate the future options prices.

Guys in this video i explain to you how to Average Down On Options. The results are added together and then divided by the total number of occurrences. To get your cost average as accurate as possible you want to enter each transaction.

Why you would average down on options. Your Free Options Prices calculator.

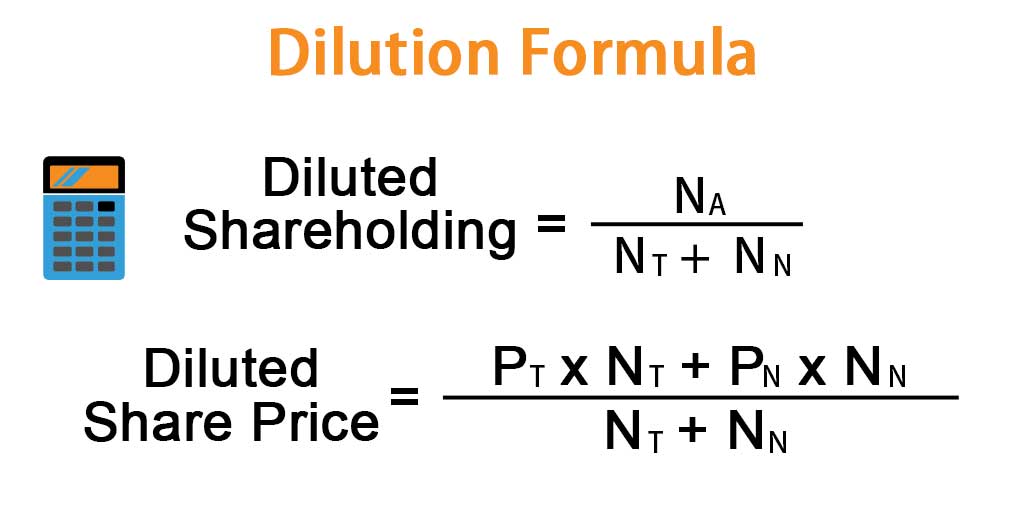

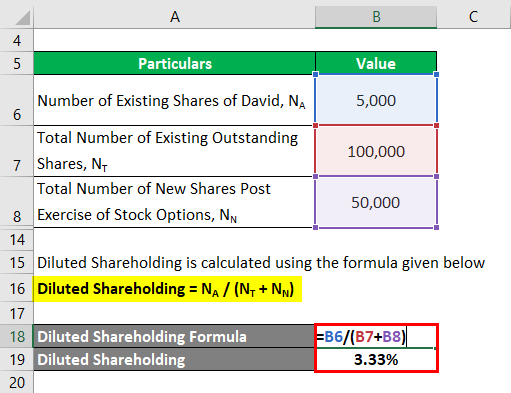

Dilution Formula Calculator Examples With Excel Template

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

:max_bytes(150000):strip_icc()/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

Average Price Definition

Calculate Grades

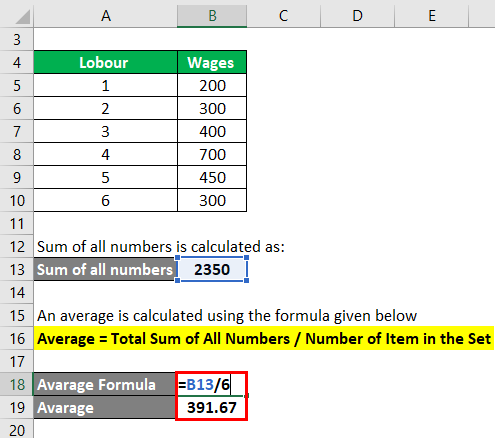

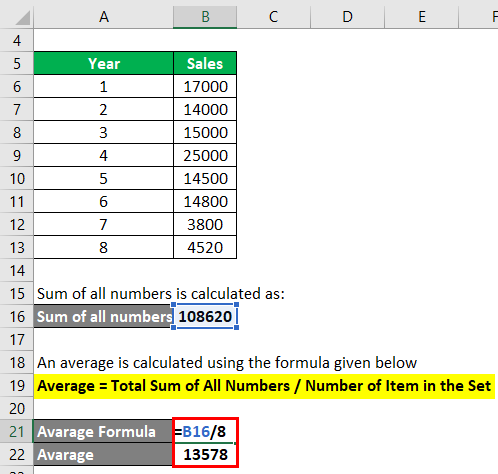

Average Formula How To Calculate Average Calculator Excel Template

Average Formula How To Calculate Average Calculator Excel Template

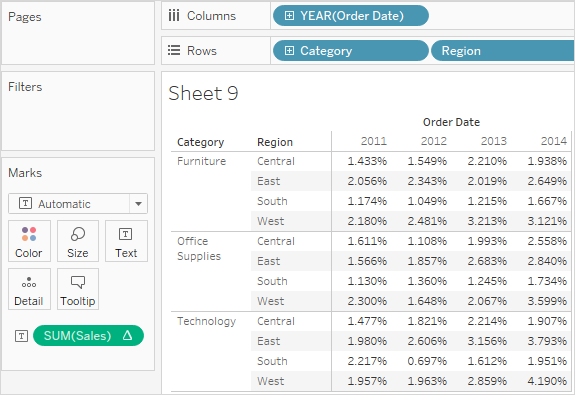

Calculate Percentages In Tableau Tableau

Understanding The Binomial Option Pricing Model

Excel Calculations Automatic Manual Iterative

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

Dilution Formula Calculator Examples With Excel Template

How To Calculate Average With Intersecting Tables Intersecting Space Character Calculator

Call Option Calculator Put Option

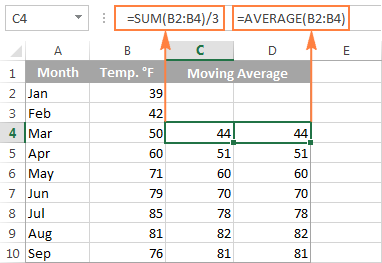

Moving Average In Excel Calculate With Formulas And Display In Charts

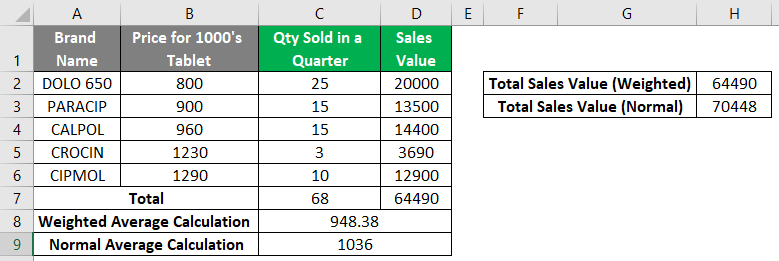

Weighted Average In Excel How To Calculate Weighted Average In Excel

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation