Mortgage calculator deposit much can borrow

Buy-to-let calculator see if we could lend you the amount you need for a property youll rent out. Government scheme offering discounts of up to 30 for.

Discount Points Calculator How To Calculate Mortgage Points

Offset calculator see how much you could save.

. Mortgage borrowing calculator Get a quick quote for how much you could borrow for a property youll live in based on your financial situation. The size of your deposit will make a massive difference to the mortgage deal you can find. Certificates of Deposit CD.

Affordability calculator get a more accurate estimate of how much you could borrow from us. Interest rates are also a consideration and in most cases mortgage lenders will ensure you will still be able to repay the amount you borrow if interest rates were to increase. 8 calculators to compare mortgages from ditching your fix to saving for a deposit.

This will be dependant on your financial situation property value and the size of your deposit or. Offset mortgage vs savings How much can I borrow. If you cant save enough some mortgages let you apply with a guarantor instead of a deposit.

Certificates of deposit CDs Mutual funds stocks and bonds. Use our mortgage calculator to see how much you may be able to borrow with a NatWest mortgage our mortgage rates and what your monthly mortgage payments could be in under 5 minutes. Plus the bigger your deposit the smaller your loan.

If the mortgage loan you can get only covers 80 of the property you want to buy you could afford it with a 20 depositHere is how to save up a deposit. This calculator tells you. However obtaining this sort of deal usually forces a borrower to pay a much higher interest rate on their loan.

Its a good indicator of whether you satisfy minimum requirements to qualify for a mortgage. Use our mortgage deposit calculator to see when youll have saved enough money for a property deposit in your area. While your personal savings goals or spending habits can impact your.

Saving a bigger deposit. Your options if youre struggling to save. However as a drawback expect it to come with a much higher interest rate.

Find out how much you could borrow with our calculator. You can calculate your mortgage qualification based on income purchase price or total monthly payment. It takes about five to ten minutes.

Your income expenses and deposit are the biggest factors determining your borrowing power but lenders also consider other factors such as your existing debts and if you are using a guarantor for the loan. Our borrowing power calculator asks you to enter details including your loan term and interest rate income and expenses and any outstanding debts. This provides a ballpark estimate of the required minimum income to afford a home.

The mortgage qualifier calculator steps you through the process of finding out how much you can borrow. A bigger deposit gives you more options and lower rates. Sometimes mortgage rates drop so much that it can be worth paying to get out of your current mortgage deal to switch to a new one at a lower rate.

Use our offset calculator to see how your savings could reduce your mortgage term or monthly payments. Our mortgage calculators can give you a rough idea of how much you could borrow for your mortgage by taking the above factors into consideration. Meanwhile some lenders may offer first-time buyers a 100 mortgage with a 0 deposit.

You put down a deposit of 5 the government lends you up to 20 in England and Wales or 40 in London and you get a mortgage to cover the remainder. MBL any Macquarie entity referred to on this page is not an authorised deposit-taking institution for the purposes of the Banking Act 1959 Cth. When it comes to calculating affordability your income debts and down payment are primary factors.

Consider this expensive trade-off before choosing a zero-deposit deal. This mortgage calculator will show how much you can afford. Factors that impact affordability.

This mortgage finances the entire propertys cost which makes an appealing option. How much can I borrow. Shows how long youd need to save for a deposit depending on the price of the property and percentage of its value you need to put down.

Find out how much you could borrow for a mortgage. If you miss your mortgage payments your guarantor has to cover them. Loan to Value LTV This is the amount of the mortgage expressed as a percentage of the property value.

If you have no deposit and need to borrow the full amount otherwise known as needing a 100 LTV - mortgage you can still get a loan but your options will be much more limited than if you had a. You can take a 100 percent mortgage if youre looking to secure a home loan without making a deposit. Your deposit is the amount of money that you need to put into the mortgage to make up 100 of the final purchase price.

This provides a rough estimate of how much you can borrow for a loan. You can also calculate your monthly repayments and interest rate. The bigger your deposit the more likely you are to get a better mortgage deal so start planning now.

Use our borrowing calculator to work out how much you could borrow for a home loan to buy a house and what your home loan repayments might be. This is usually one percent higher than a mortgage that requires a deposit. How much can I borrow.

A 95 mortgage also known as a 95 loan-to-value LTV mortgage is a mortgage to purchase a property with a small deposit at least 5 but less than 10 deposit of the purchase price. Mortgage calculator Mortgage repayment calculator Stamp duty calculator Mortgage deposit. That entitys obligations do not represent deposits or.

Help is at hand if youre struggling to save up a big enough deposit for your first home. 2000 cashback when you refinance to us If youre eligible and you apply to move your home loan to us by 28 February 2023 you could get less home load with 2000 cashback. Help to Buy equity loan.

Fill in the entry fields and click on the View Report button to see a complete amortization schedule of the mortgage payments Bankrate. If you want a more accurate quote use our affordability calculator. How much house you can afford is also dependent on the interest rate you get because a lower interest rate could significantly lower your monthly mortgage payment.

While every mortgage lender has their own criteria for determining how much you can borrow they all look at the following key factors when calculating a buy to let mortgage. Before applying for a mortgage you can use our calculator above.

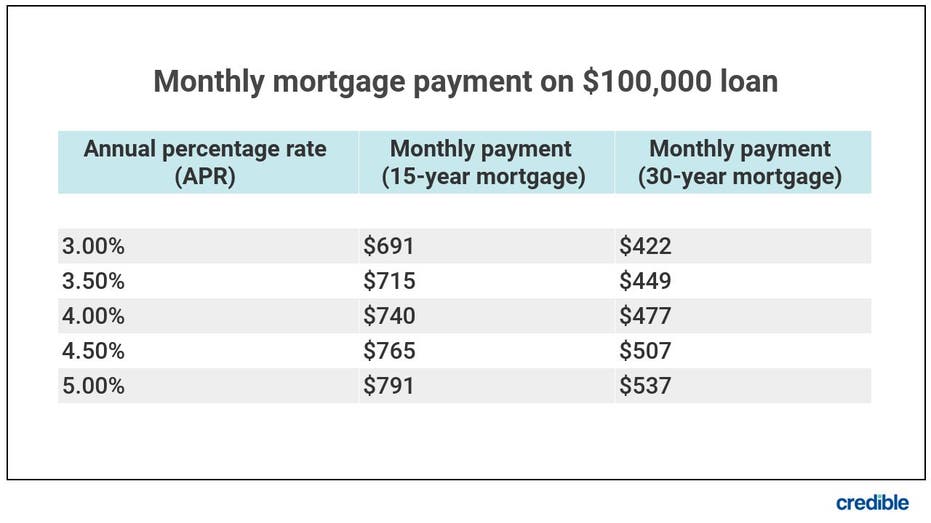

Here S How Much A 100 000 Mortgage Will Cost You Fox Business

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Tips On Home Warranty Coverage For Home Owners Home Security Tips Home Security Home Warranty

How Much Can I Borrow Home Loan Calculator

Mortgage Calculator Money

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

A Home Of Your Own Home Buying Living Room Accessories Living Room Theaters

What S My Monthly Mortgage Payment First Financial Bank

Emi Calculator Easy To Know Your Monthly Loan Payment Personal Loans Loan Calculator Paying Off Mortgage Faster

Need To Borrow Funds Know Which Loans Best Suits Your Needs Financial Aid For College World Finance Business Loans

5 Signs Real Estate Agents Can Stretch The Truth Real Estate Agent Real Estate Real Estate Career

5 Ways To Get A High Lvr Home Loan Credit Repair The Borrowers Loan

/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

How Much A 350 000 Mortgage Will Cost You Credible

Slash Interest Rates With These 4 Easy Tips Refinance Loans Interest Rates Loan Rates

Guarantor Home Loans Borrow 105 Home Loans The Borrowers Loan

How To Increase The Amount You Can Borrow My Simple Mortgage